When I joined Shoobx as a very early employee I received an option grant, “Welcome aboard!” Because the company wants its employees to benefit from the potential tax advantages it offers, Shoobx permits early exercise of options. This means I was able to exercise all of my shares when I started—before they had actually vested. At that point, my new colleagues clued me into the fact that I would likely want to file an 83(b) election with the IRS, “Just do it, Jen,” and encouraged me to do so in a timely fashion, “You only have 30 days, don’t %!&@# it up.”

In simple terms, an 83(b) election is a letter you send to your friends at the IRS letting them know you’d like to be taxed now on your equity. 83(b) is named for the relevant section of the Internal Revenue Code. Check out our blog post, The Buzz about 83(b), to learn more, including the possible tax implications.

Based on some helpful guidance, I decided that an 83(b) election was the right choice for me and here are the exact steps I followed to file it:

- Purchase the shares. I signed the paperwork and handed over a check for the purchase amount. With that my 30-day filing clock started ticking.

- Fill out a cover letter and election form. I added my information to the standard cover letter to the IRS and completed the 83(b) election form. (If you are lucky enough to be a Shoobx user, this is super easy because Shoobx has templates and will create these documents for you.)

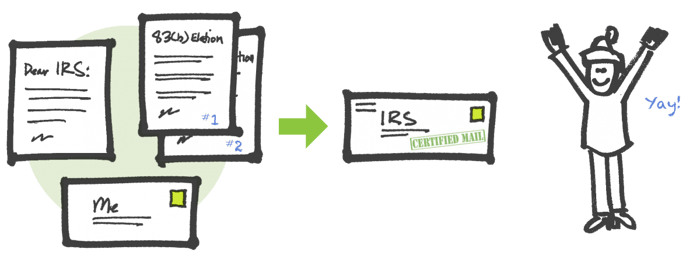

- Assemble everything to mail to the IRS. In my cover letter I asked the IRS to date stamp a copy of the election form and mail it back to me, so I enclosed a second copy of the election form along with an envelope addressed to me and a stamp already on it. Here’s everything I put in the envelope:

- Cover letter

- 83(b) election form

- Second copy of the 83(b) election form

- Self-addressed stamped envelope

I addressed the envelope to the IRS using the address where I would mail my personal tax return if I were not making a payment. (This varies by state of residence and can be found on the IRS website. Click on your state, then look for where you would mail a 1040 without a payment.)

- Send it certified mail. Apparently, the IRS is quite serious about the 30-day deadline. (If you miss it there’s no recourse. Don’t bother crying or begging for mercy.) Therefore, I sashayed down to my local post office and sent it via certified mail with return receipt. This served as proof that I sent it within the time window until I got my stamped copy back from the IRS.

- Wait an indeterminate period of time. It took a few weeks for me to get my stamped copy back from the IRS. (Based on the anecdotal evidence of my co-workers, the amount of time you wait is highly variable.)

- Give a copy to the company. I made a copy of the stamped 83(b) election and gave it to my employer. I also kept a copy for my personal records. (If you are a Shoobx user, Shoobx will safely store your 83(b) election form for you.)

That’s what I did. If you decide an 83(b) election is right for you, I hope you’ll find this helpful. But remember: the IRS is always the definitive expert on the IRS—and the rules may change from year to year (like whether you have to include a copy with your tax return or not)—so check with them if you have any questions.

Need a platform that helps you manage all of your documentation? You're in the right place.