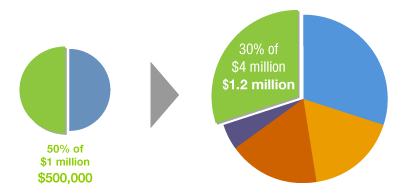

The basic concept of dilution for startups is simple: As you grant equity in your company, your ownership percentage will go down. Why does this happen? Imagine you have a pie that is divided into halves—evenly split for two people. In order to give some pie to a third person, one or both of the original shares will have to get smaller.

Startups need capital to grow. Investors trade this capital for equity, i.e. ownership in the company. The goal of the founders and other owners is to grow the entire pie enough that the smaller percentage they accept will be worth more than the piece they began with.

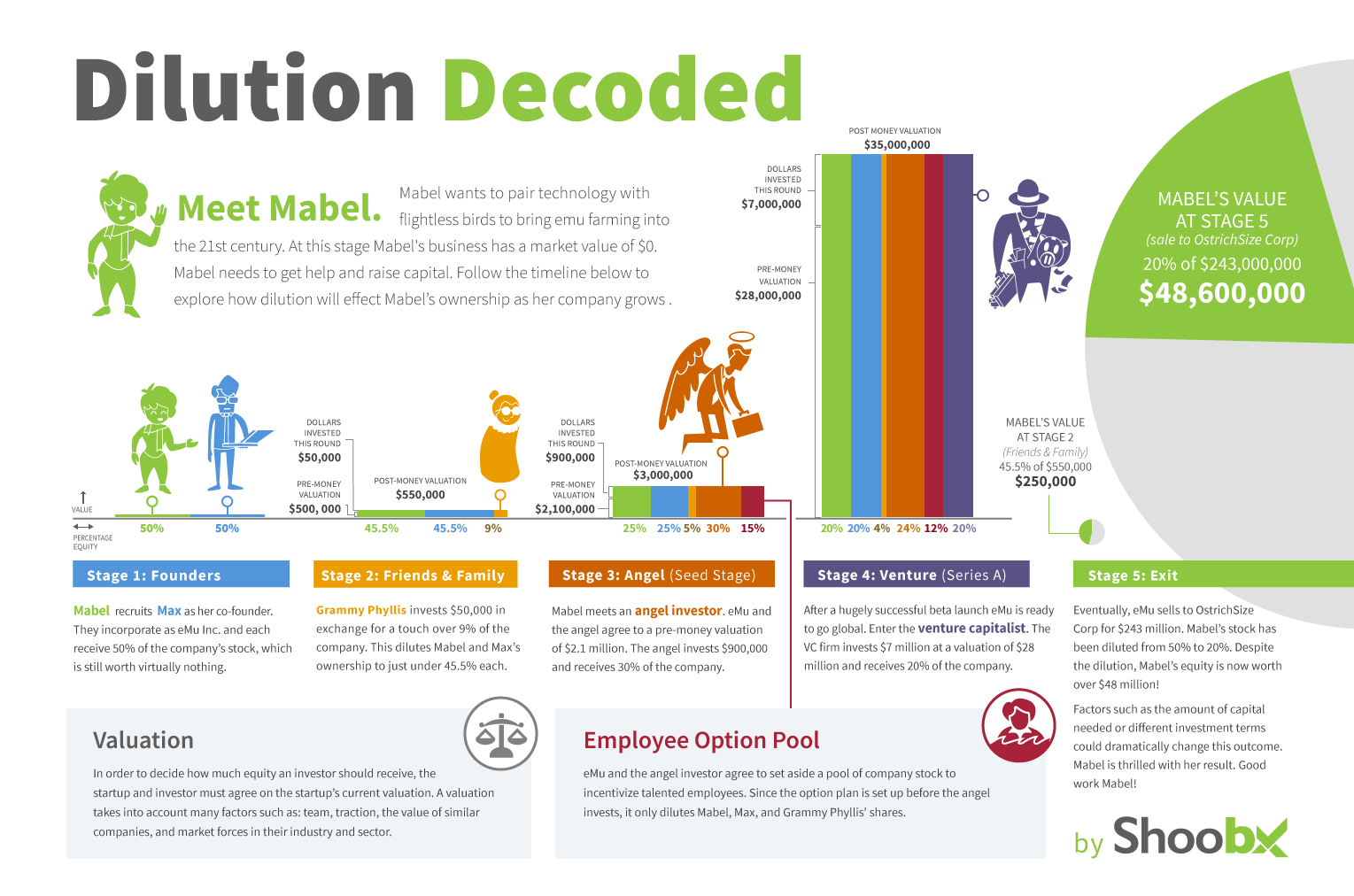

To understand the impact of dilution over multiple rounds of investment and growth, we’ve tracked a fictitious startup—whose technology will disrupt the flightless bird industry—from formation to exit so you can see the change in value of one founder’s shares:

Looking at the value of one founder’s ownership over time, we can see it grow (from $0 to an exit worth $48.6 million) despite the fact that his ownership percentage decreases at each round to accommodate additional investors. At each step, the dilution he accepted in exchange for the capital necessary for his business to take flight (pun intended) paid off. Not every company will have that outcome but understanding the potential impact dilution can have will drive savvy decision making for any business.

Want to make sure your cap table stays accurate and up-to-date? Fidelity is here to help.